Hello everybody, and invite back to the blog site! I’m always enjoyed connect with fellow freelancers and small company owners browsing the often-complex world of taxes. Today, we’re diving into a vital form that regularly causes confusion: the W-9. As somebody who’s invested years encouraging on tax matters, I’ve seen direct how a little clarity on this form can save you a lot of headaches down the line. So, let’s demystify the W-9, and as a special thank you for reading, I’m also providing a complimentary download of some fun polar bear coloring pages and templates– ideal for a relaxing break after tackling taxes!

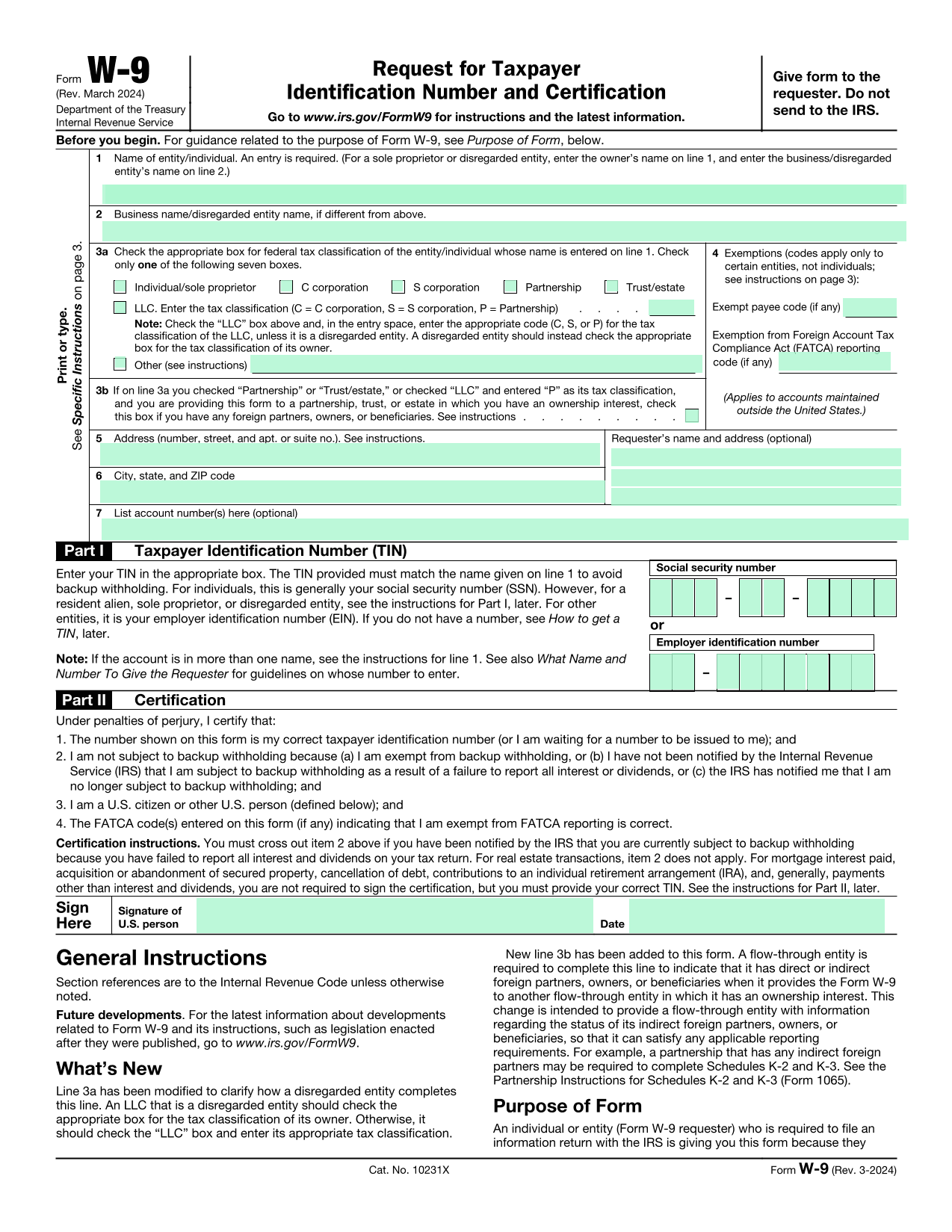

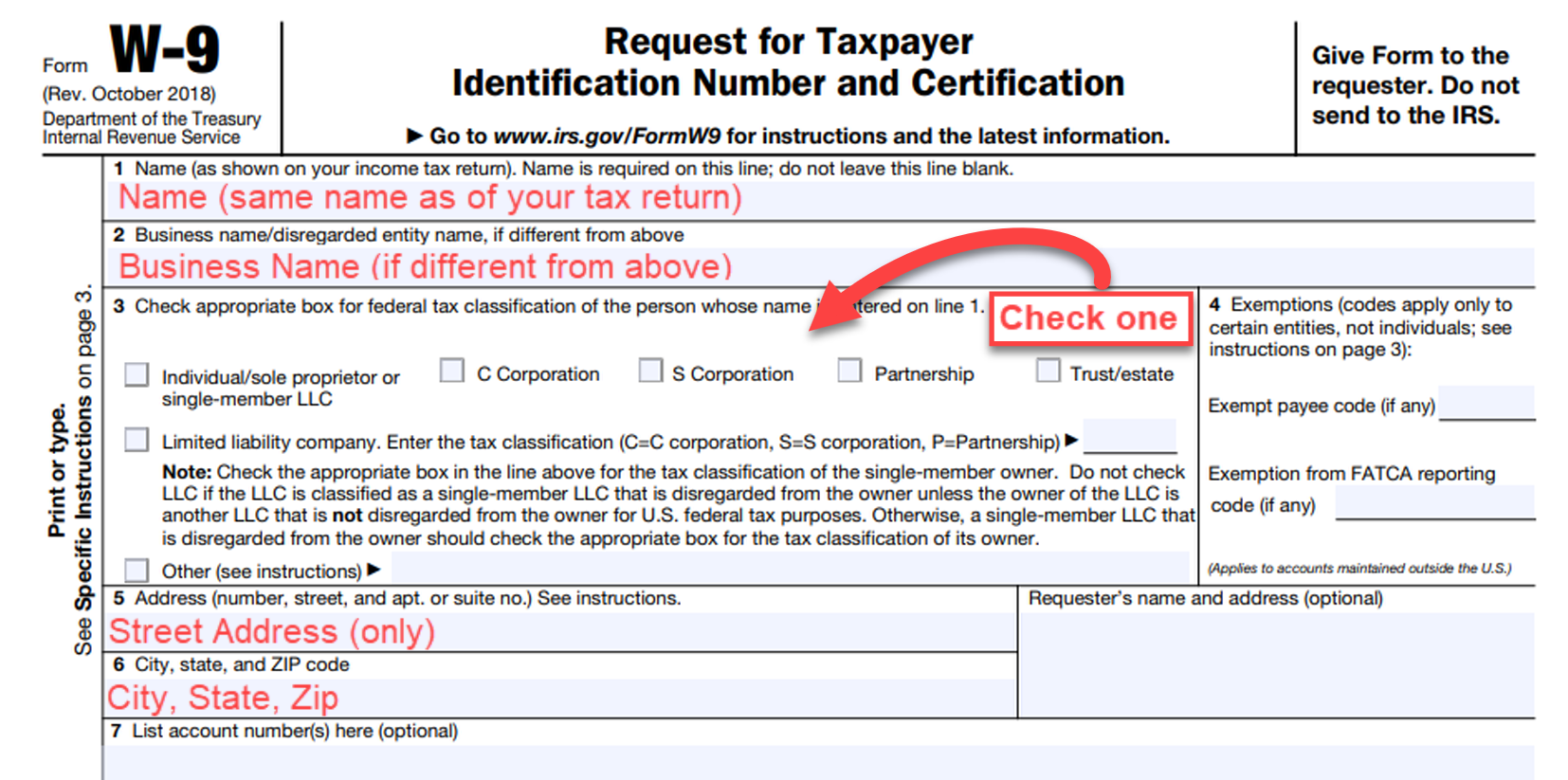

The W-9, formally titled “Request for Taxpayer Identification Number (TIN) and Certification,” isn’t a type you submit with the IRS. Rather, it’s a kind you offer to your clients. Think of it as your company’s vital information sheet for tax purposes. When a client pays you $600 or more in a calendar year for services rendered, they are usually needed to report those payments to the IRS using Form 1099-NEC (or 1099-MISC in particular scenarios). To accurately complete this reporting, they need your right taxpayer recognition details, which is specifically what the W-9 supplies.

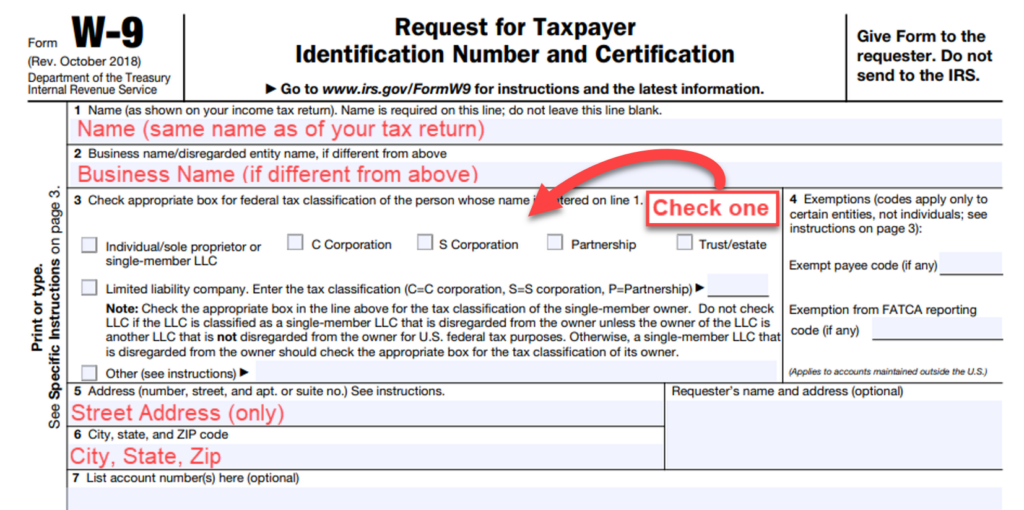

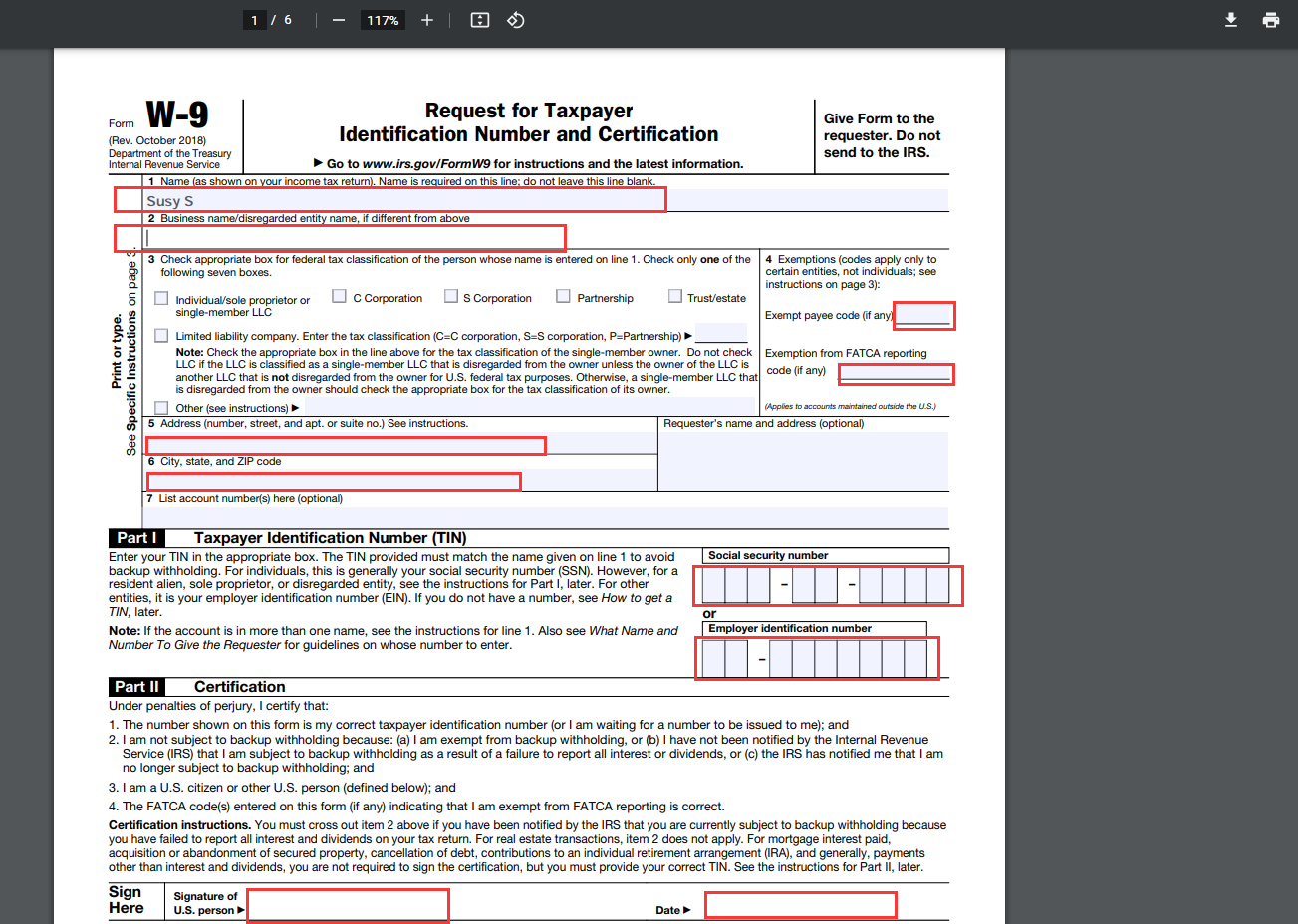

Fillable Irs Form W9

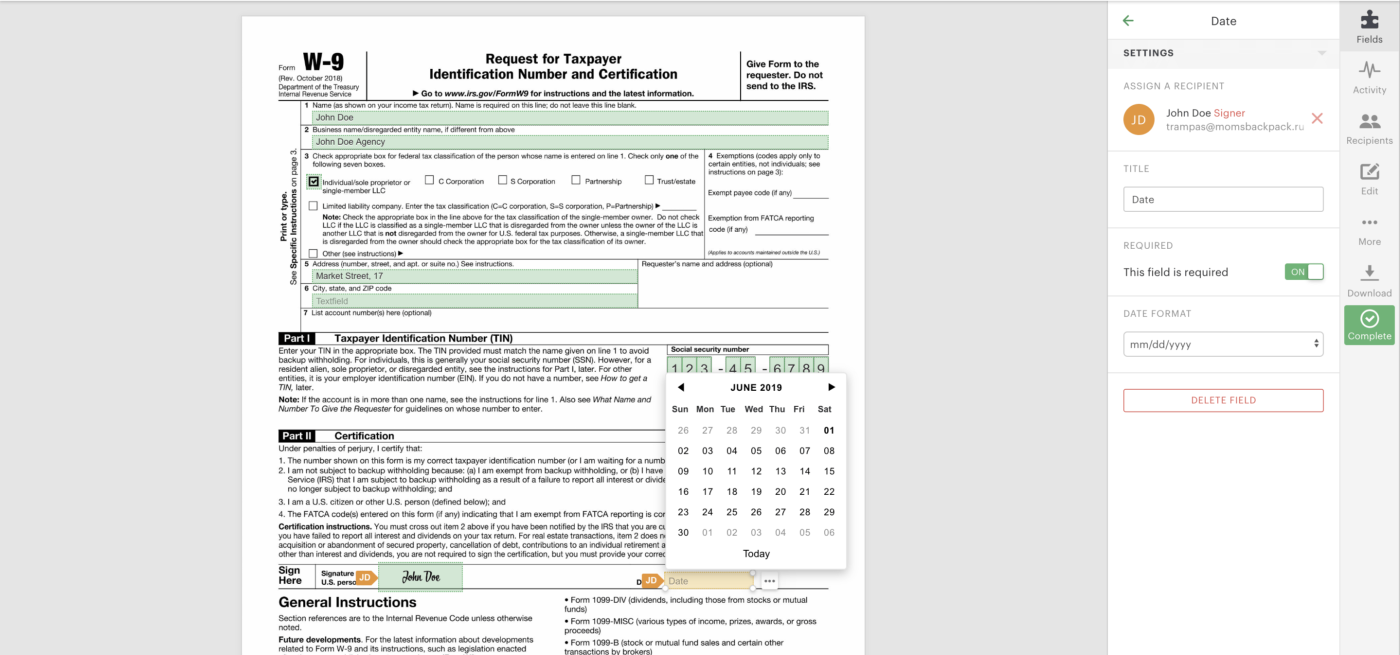

How To Create And Sign A W 9 Form Online

source : www.pandadoc.com

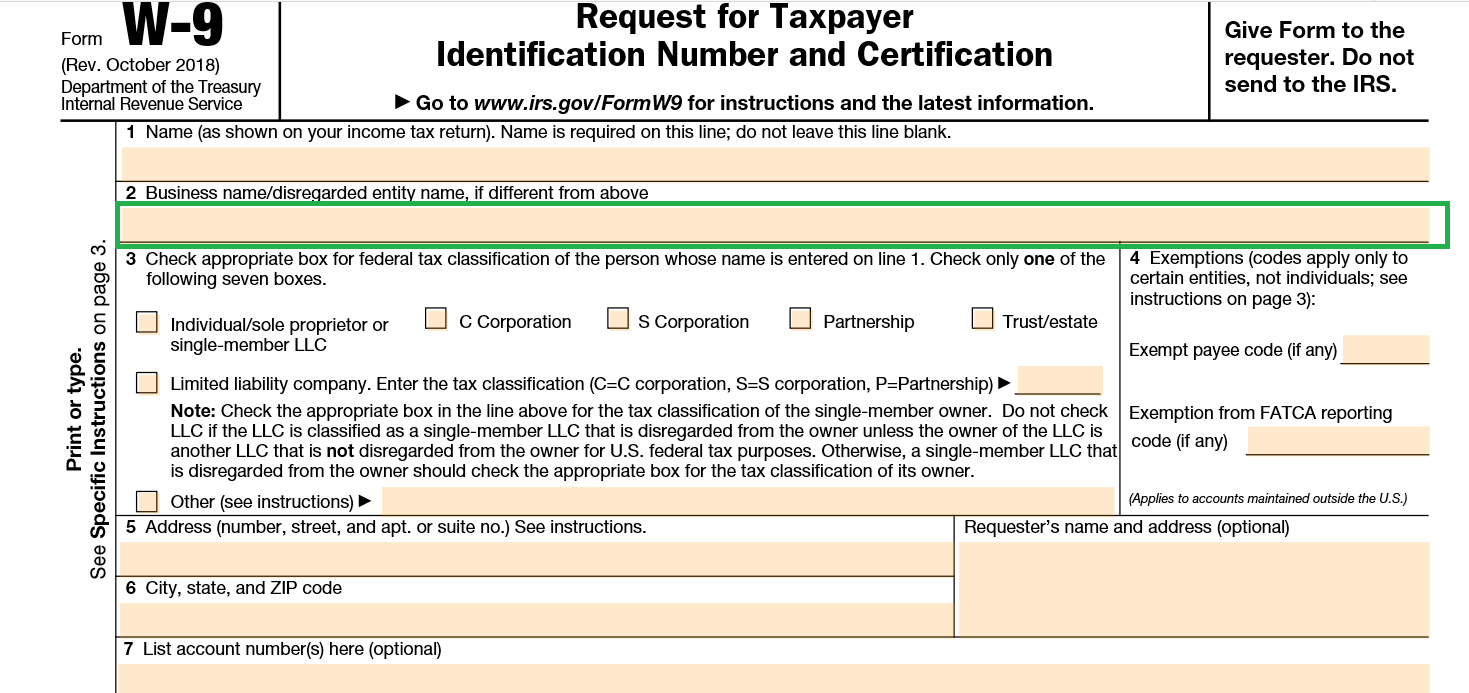

Form W 9 Complete Instructions Download FREE PDF

source : www.taxbandits.com

A typical question I receive is: “When should I fill out a W-9?” The answer is simple: whenever a client requests it. It’s a basic service practice, and promptly providing a finished W-9 demonstrates your professionalism and helps keep a smooth client relationship. Don’t wait up until the end of the year when your client is rushing to issue 1099s.

Fillable Irs Form W9 – Another important point to remember is that you should never ever send your W-9 to the IRS. You just offer it to the requesting payer. Keep a copy for your own records, though. This will assist you reconcile any 1099s you get at the end of the tax year.

Finally, let’s resolve the “fillable printable” aspect. While the IRS offers a PDF version of the W-9 that can be filled out electronically, it’s always good practice to keep a blank, copy on hand. This is particularly practical if you’re fulfilling a customer face to face or if you choose to have a physical copy for your records.

How To Complete An IRS W 9 Form YouTube

source : m.youtube.com

All About W 9 Form What It Is What It Is Used For And How To Fill It Out

source : www.swifdoo.com

Free Blank W 9 Printable Form Fill Out Sign Online DocHub

source : www.dochub.com

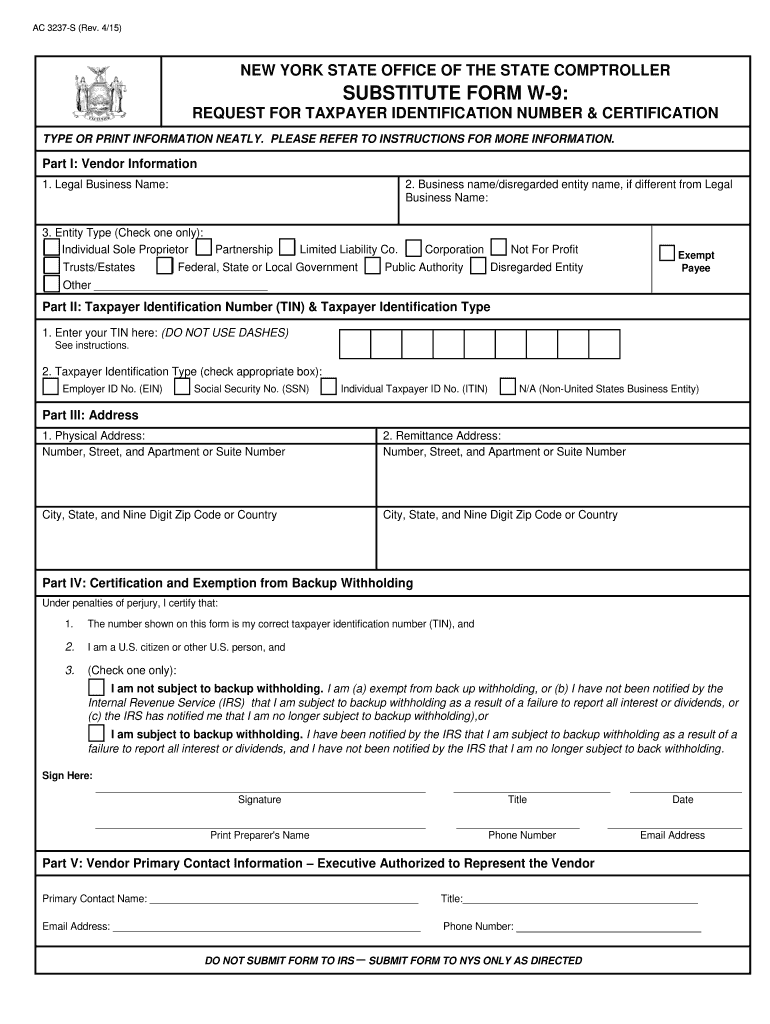

2015 NY Substitute Form W 9 Fill Online Printable Fillable Blank PdfFiller

source : www.pdffiller.com

Understanding the W-9 is a fundamental part of running a successful freelance company. By guaranteeing you offer accurate info and react promptly to client requests, you can avoid unnecessary complications and concentrate on what you do best.

And now, as guaranteed, here’s your little reward! As a thank you for making the effort to read this post, I’m using a free download of some lovable polar bear coloring pages and design templates. It’s a small method to include a little bit of fun to your day and supply a relaxing activity after navigating the sometimes-dry topic of taxes. You can discover the download link [Insert Download Link Here] I hope you enjoy them!

As constantly, if you have any questions about the W-9 or any other tax-related matters, do not hesitate to leave a comment below. I’m constantly delighted to assist. Up until next time, remain organized, remain notified, and delighted freelancing!

W9 Form Free Download Fillable Printable PDF 2022 CocoDoc

source : w9.cocodoc.com

W 9 Form Fill Out The IRS W 9 Form Online For 2023 Smallpdf

source : smallpdf.com

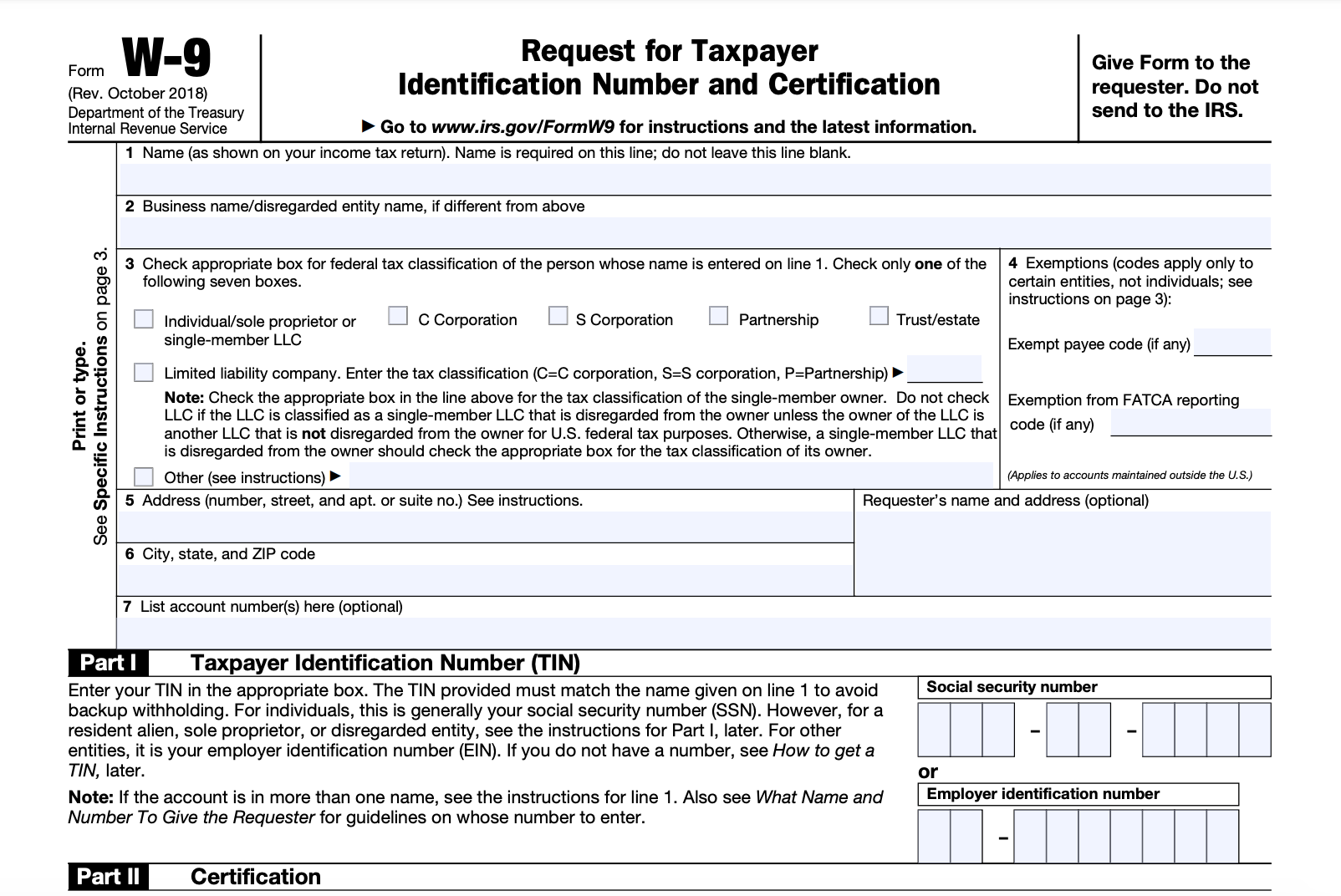

IRS W 9

source : www.useanvil.com

Free IRS Form W9 2024 PDF EForms

source : eforms.com