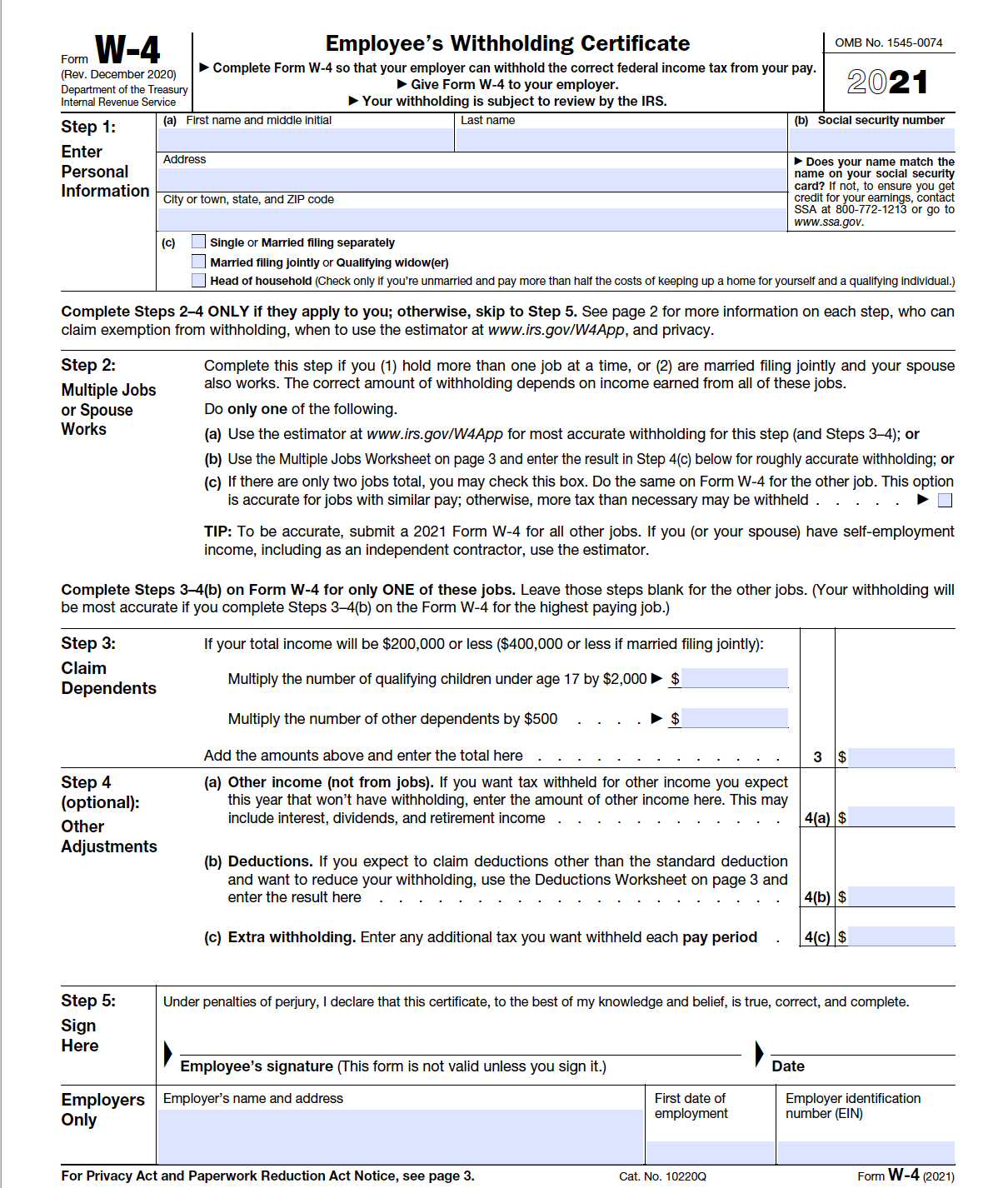

Hello everyone, and welcome back to the blog! I’m constantly enjoyed connect with fellow freelancers and small company owners browsing the often-complex world of taxes. Today, we’re diving into a vital kind that regularly triggers confusion: the W-9. As someone who’s invested years recommending on tax matters, I’ve seen direct how a little clearness on this type can conserve you a great deal of headaches down the line. So, let’s debunk the W-9, and as an unique thank you for reading, I’m likewise using a complimentary download of some enjoyable polar bear coloring pages and templates– perfect for a relaxing break after dealing with taxes!

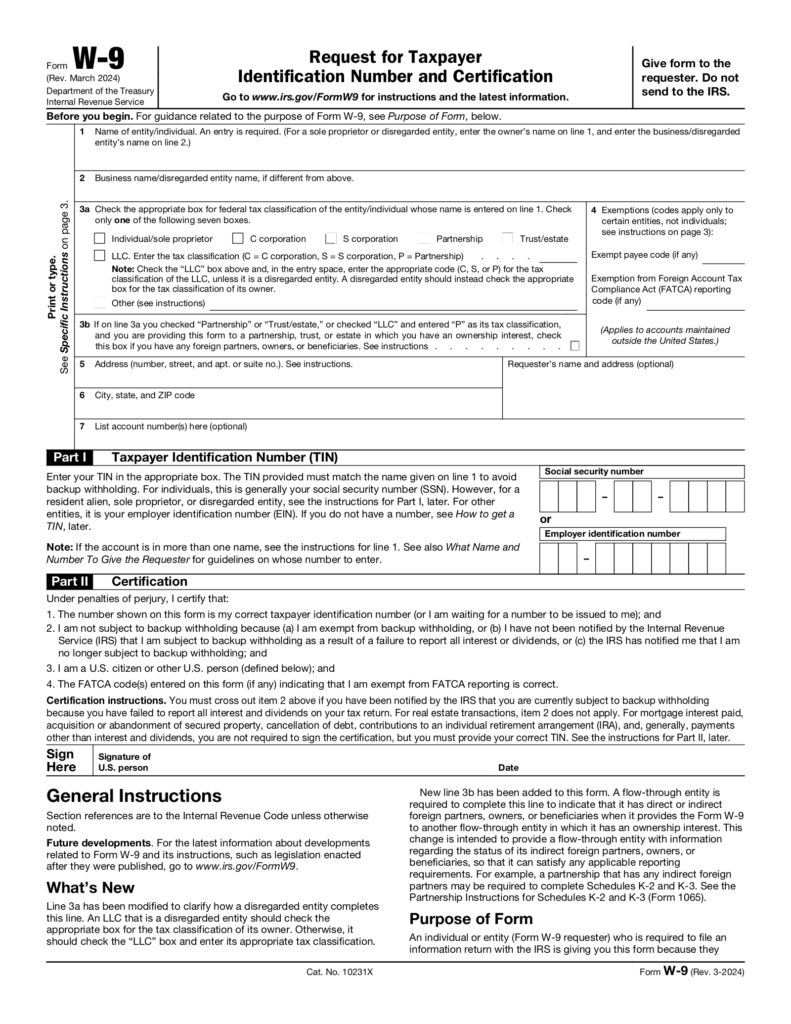

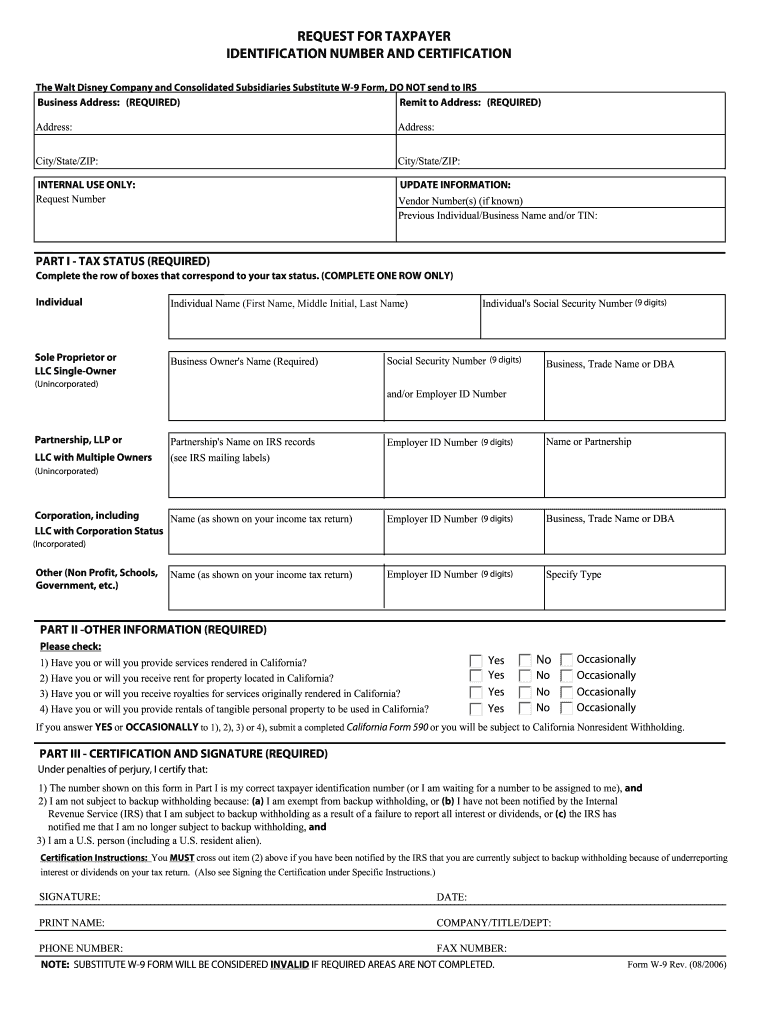

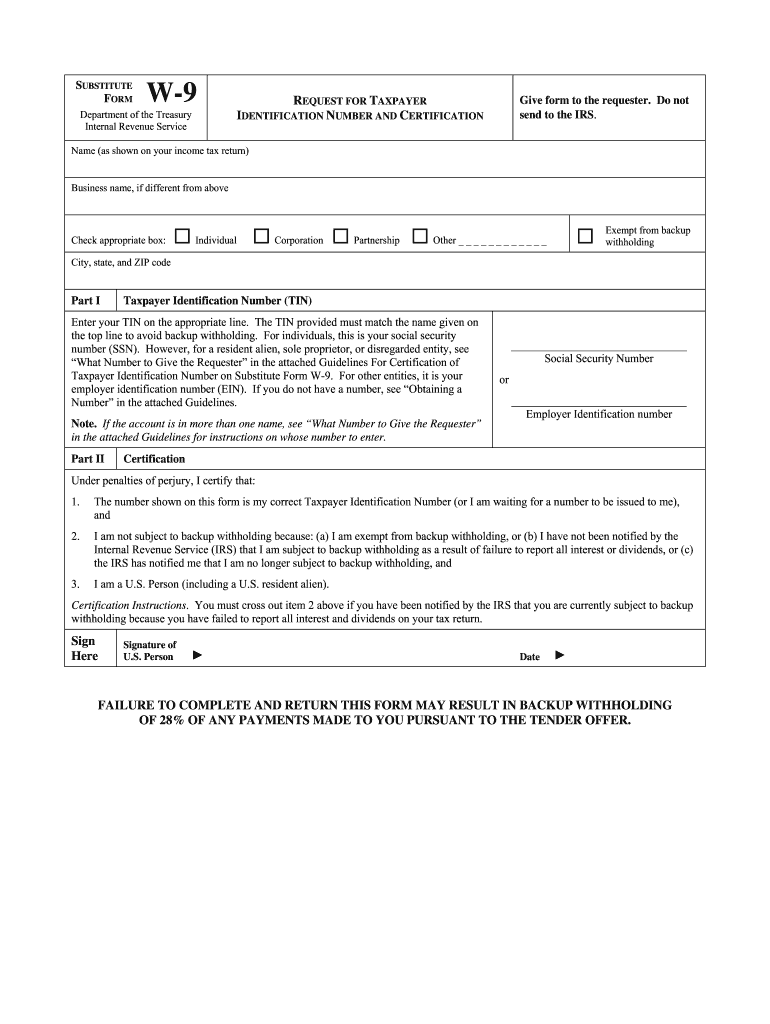

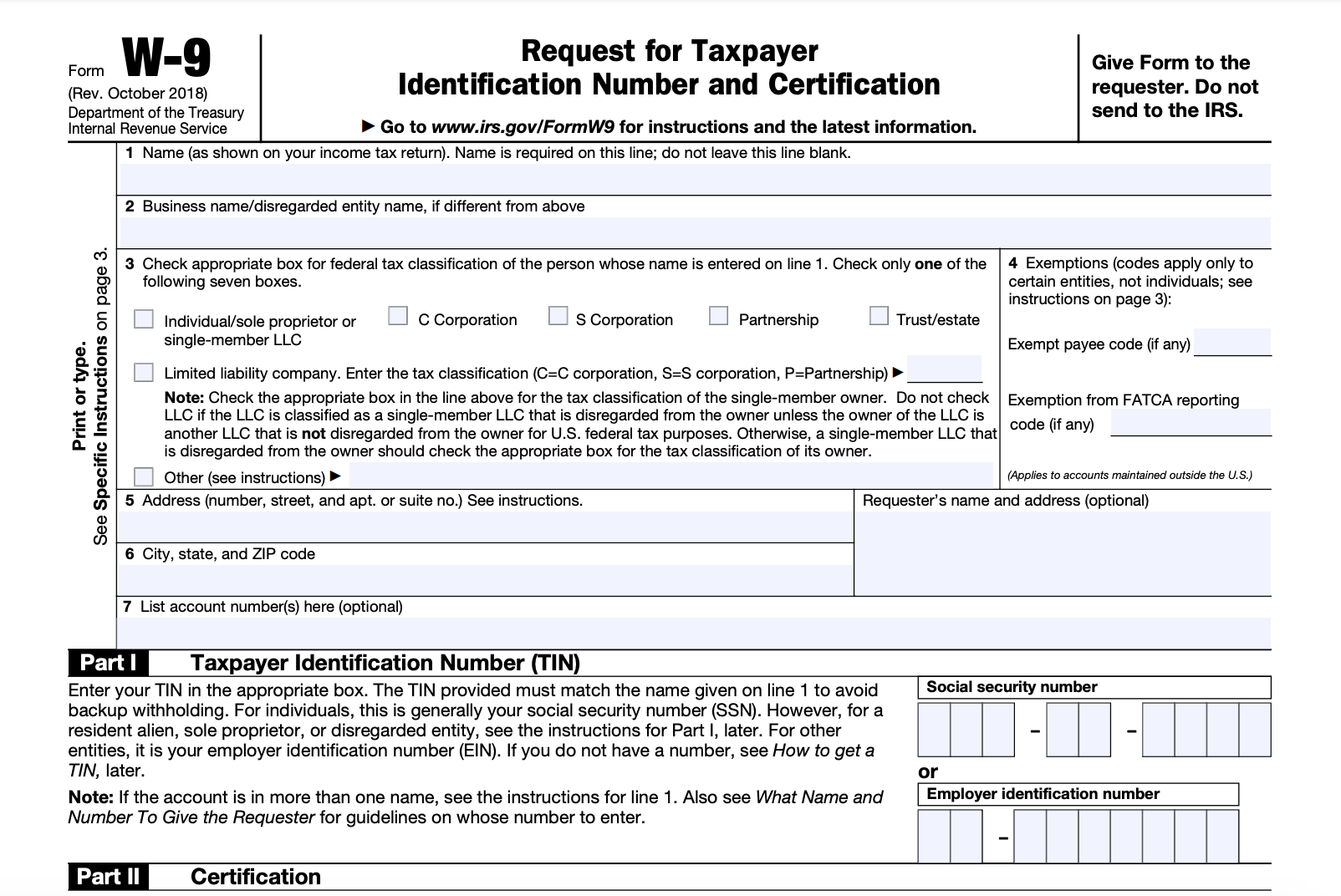

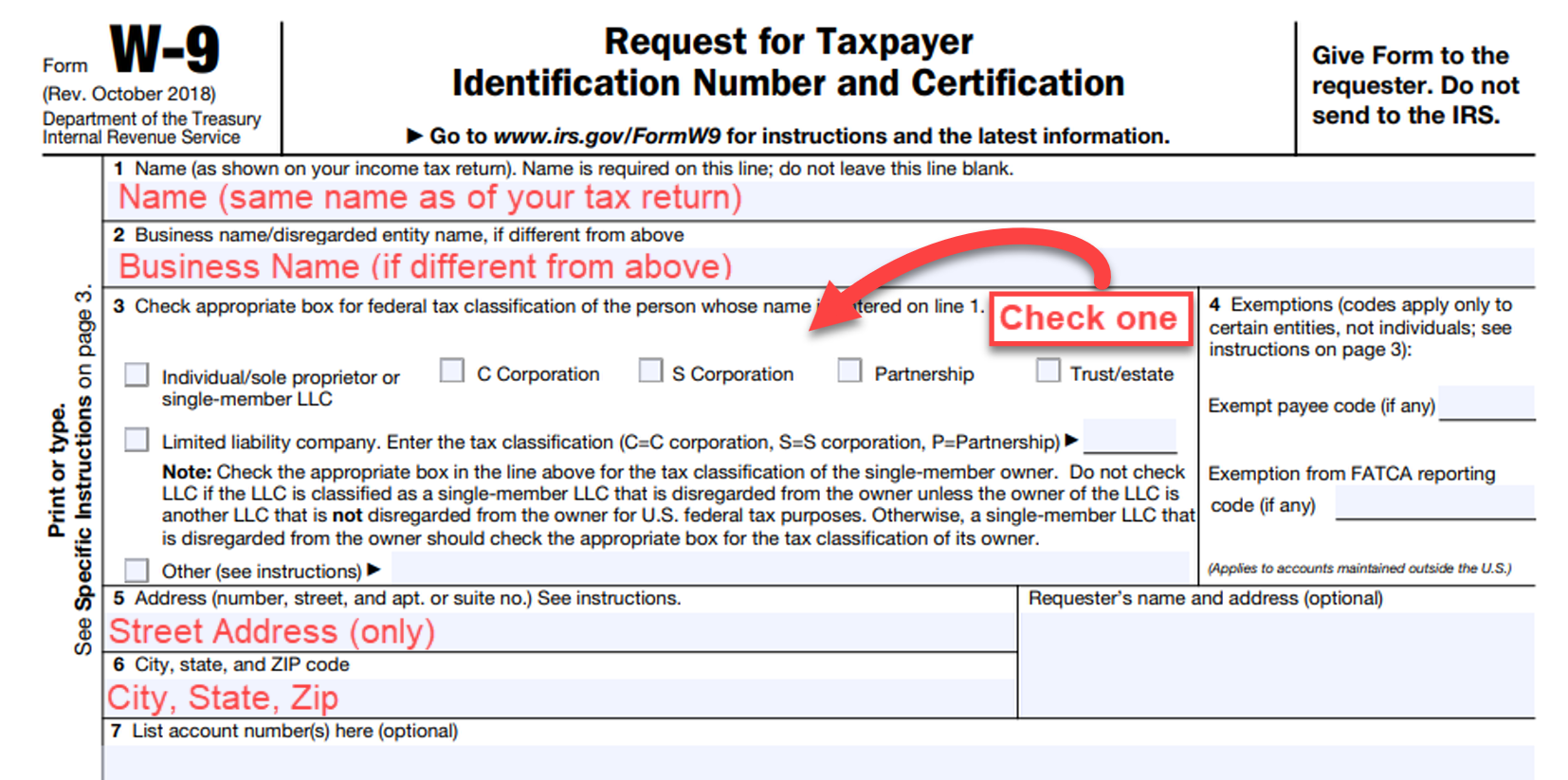

The W-9, formally entitled “Request for Taxpayer Identification Number (TIN) and Certification,” isn’t a type you file with the IRS. Rather, it’s a kind you offer to your customers. Think about it as your organization’s essential information sheet for tax functions. When a customer pays you $600 or more in a calendar year for services rendered, they are usually needed to report those payments to the IRS utilizing Form 1099-NEC (or 1099-MISC in certain situations). To accurately finish this reporting, they need your appropriate taxpayer identification info, which is exactly what the W-9 provides.

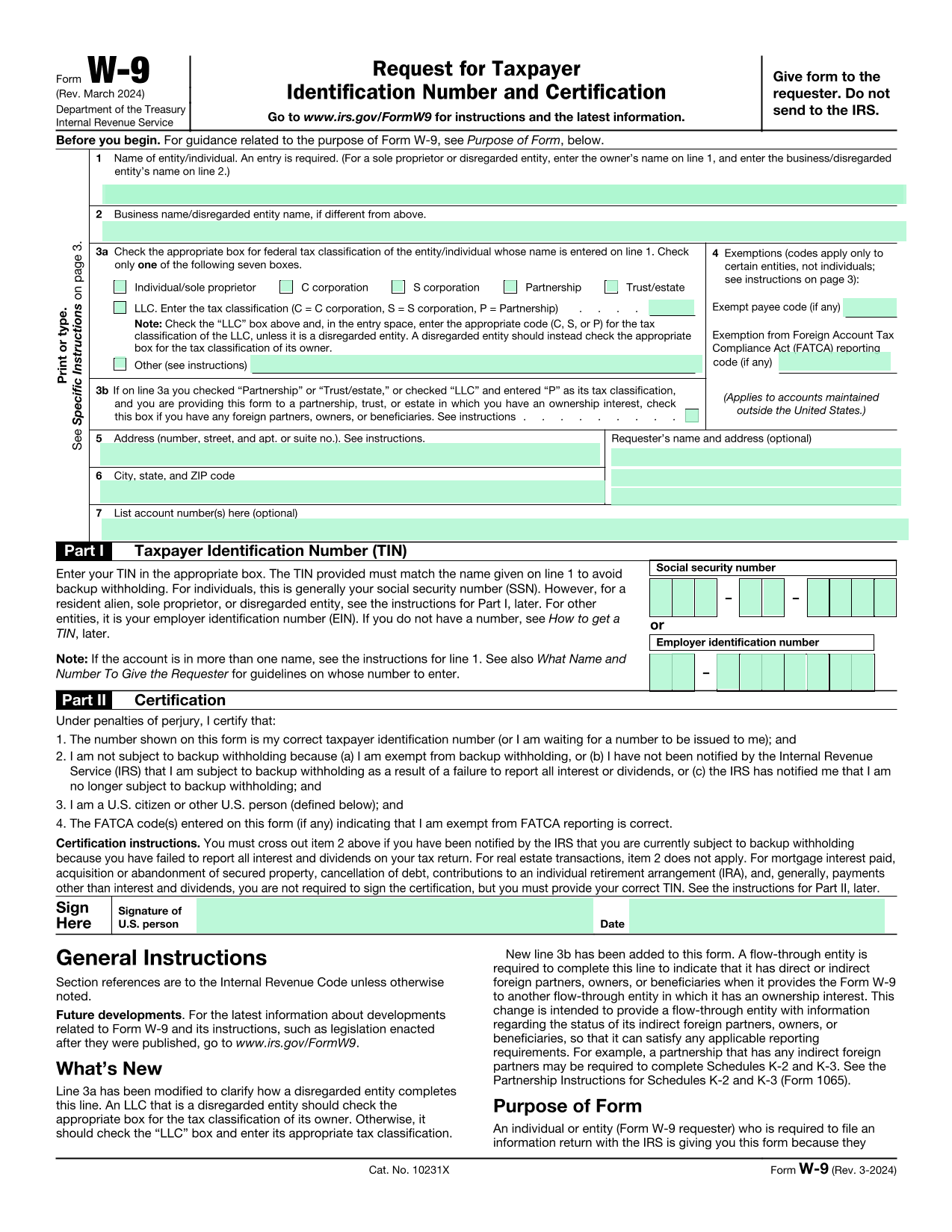

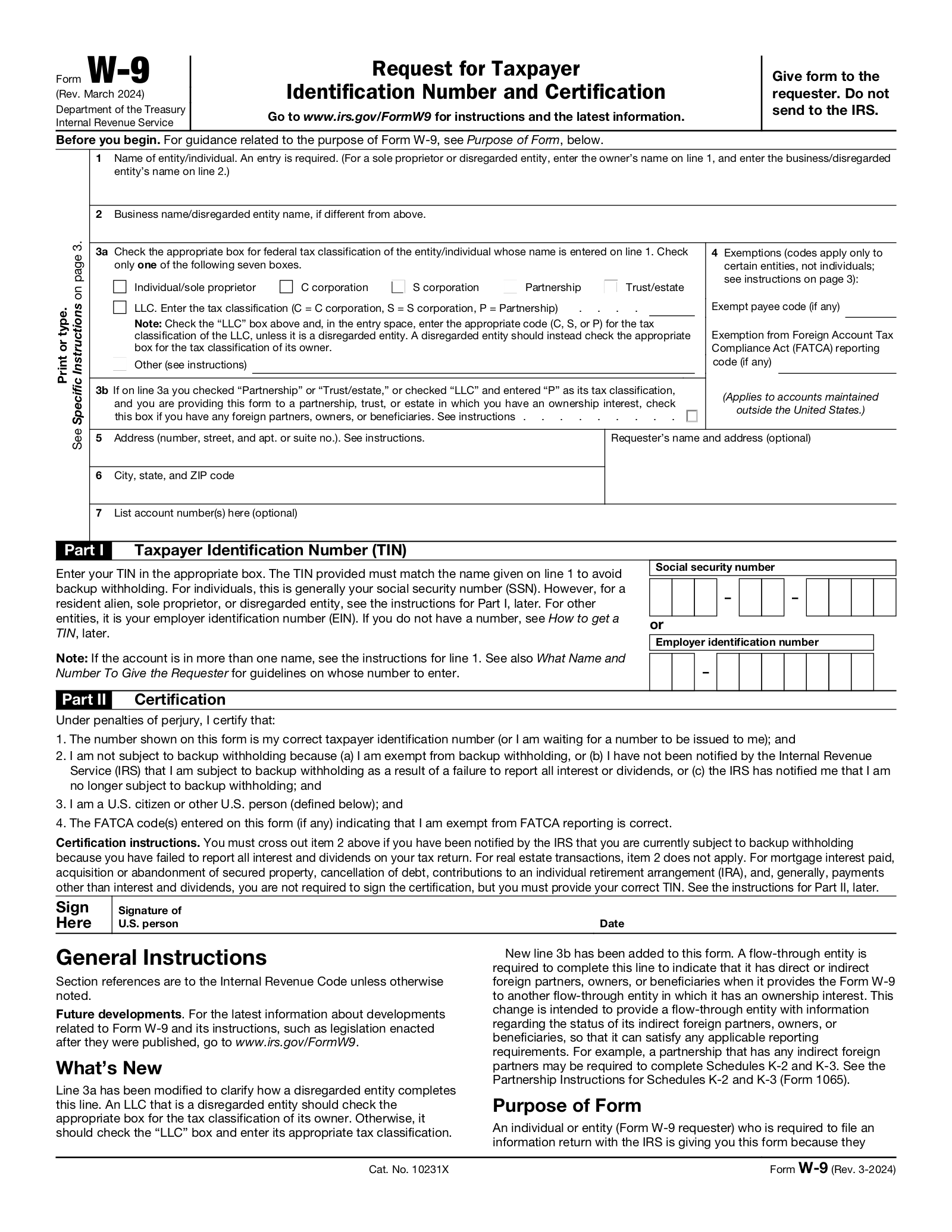

2025 Printable W9 Form Taxes

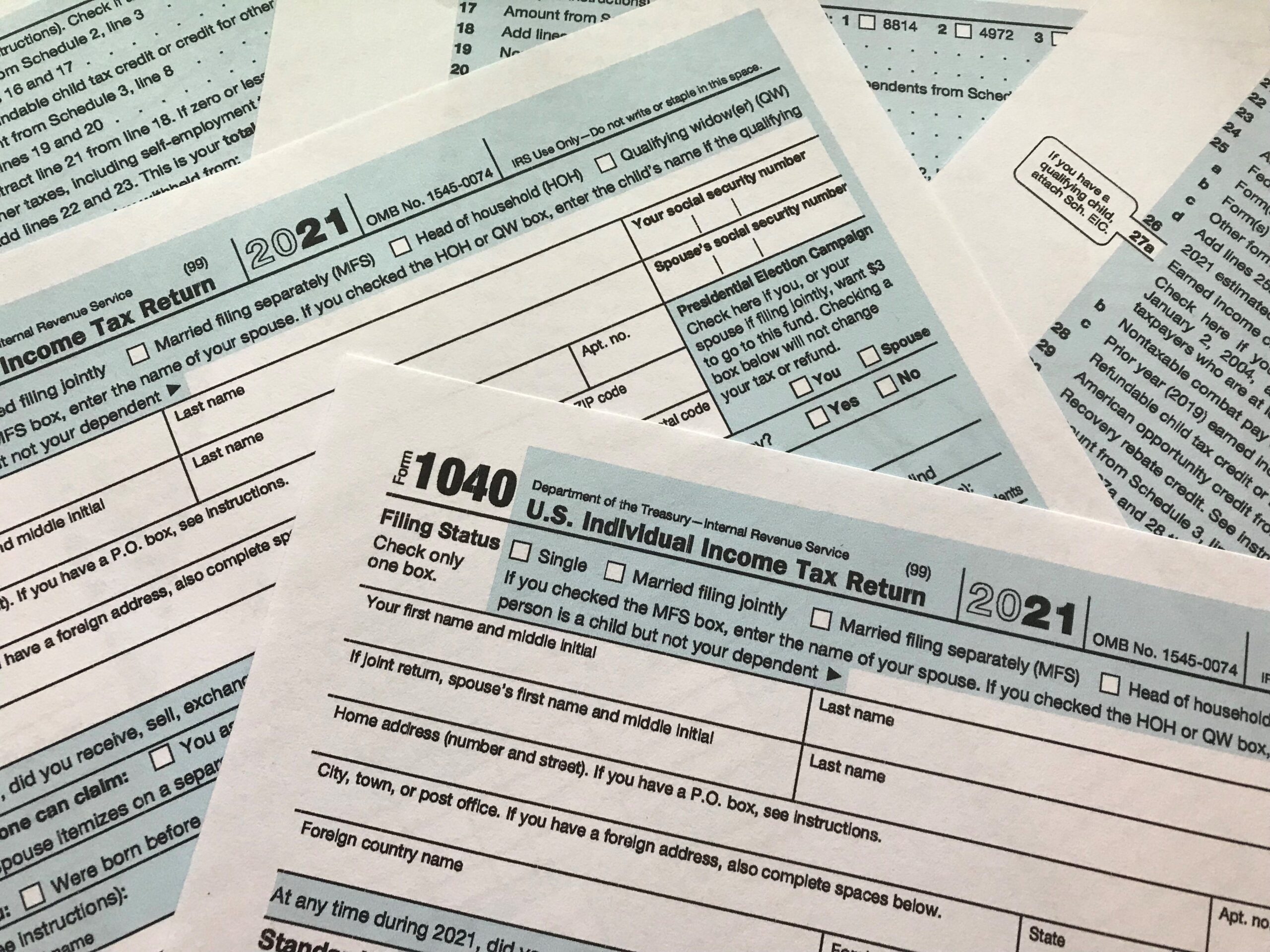

Do You Know A W 9 From A 1099 Here Are The Forms You Ll Need When You File Taxes In 2025

source : www.usatoday.com

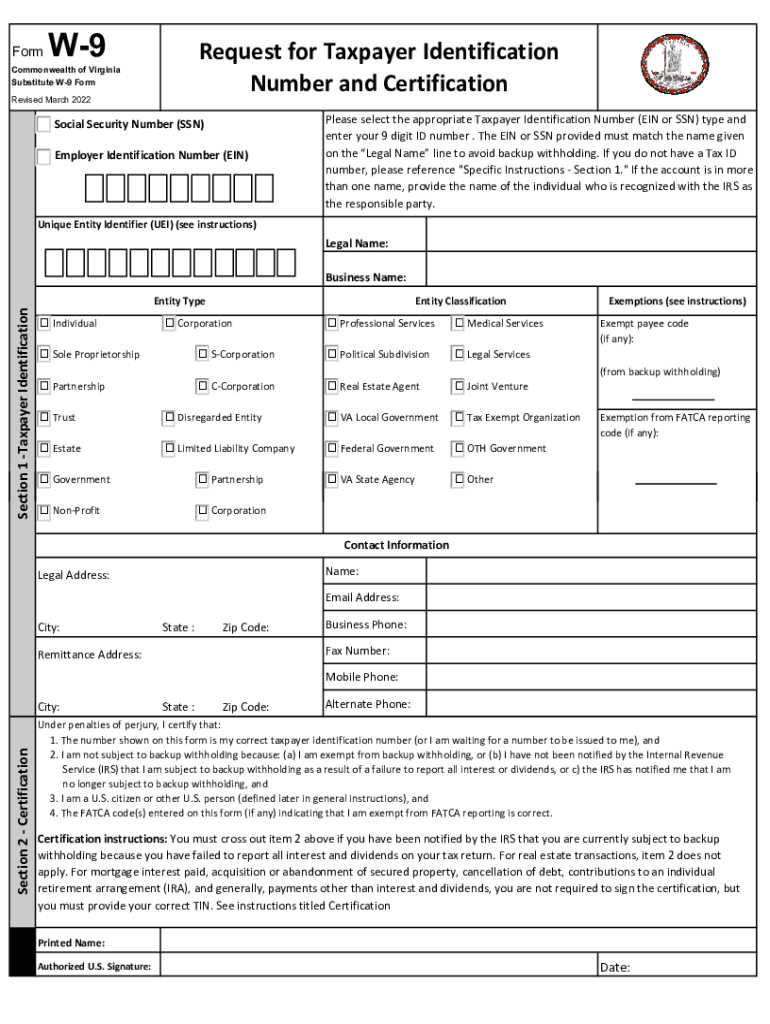

2022 2025 Form VA Substitute W 9 Fill Online Printable Fillable Blank PdfFiller

source : virginia-state-w-9-form.pdffiller.com

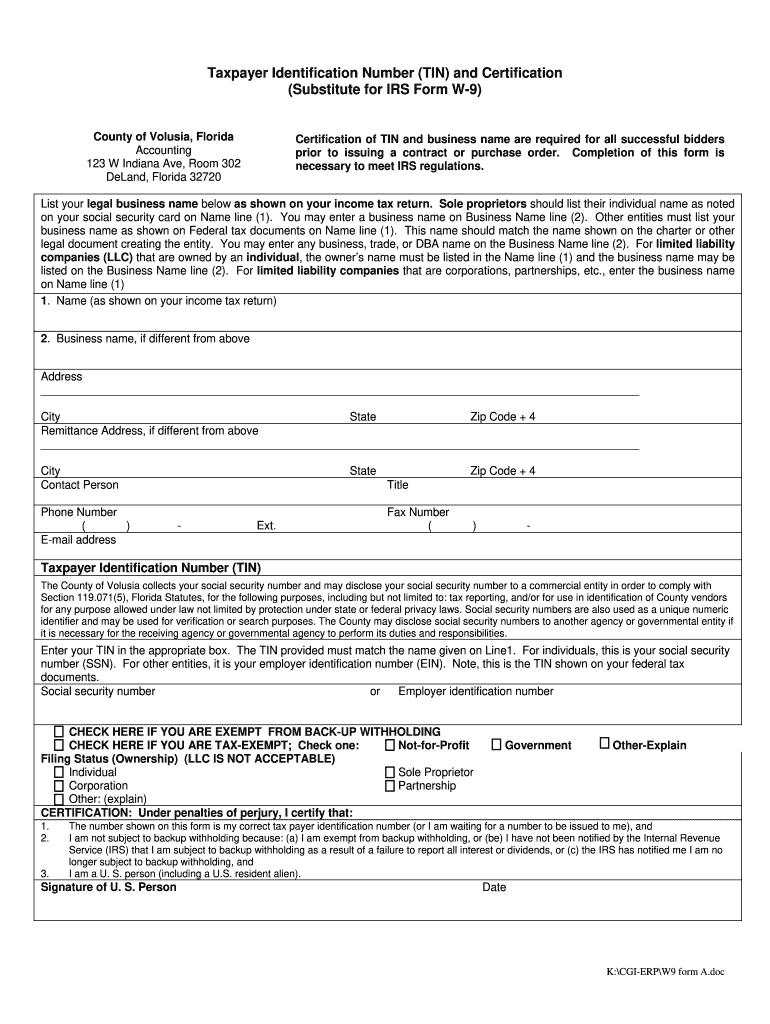

A typical question I get is: “When should I complete a W-9?” The answer is easy: whenever a client requests it. It’s a standard business practice, and promptly providing a completed W-9 shows your professionalism and helps preserve a smooth client relationship. Don’t wait until completion of the year when your client is scrambling to issue 1099s.

2025 Printable W9 Form Taxes – Another important point to remember is that you should never ever send your W-9 to the IRS. You just offer it to the requesting payer. Keep a copy for your own records, though. This will help you fix up any 1099s you receive at the end of the tax year.

Lastly, let’s deal with the “fillable ” element. While the IRS supplies a PDF version of the W-9 that can be filled out digitally, it’s constantly excellent practice to keep a blank, printable copy on hand. This is especially helpful if you’re meeting a customer face to face or if you choose to have a physical copy for your records.

W9 Word Doc Fill Out Sign Online DocHub

source : www.dochub.com

Fillable W 9 Form Template Formstack Documents

source : www.formstack.com

W9 Form Fill Online Printable Fillable Blank PdfFiller

source : w9-form.pdffiller.com

What Is A W9 Form Fill Out Sign Online DocHub

source : www.dochub.com

Understanding the W-9 is an essential part of running an effective freelance company. By ensuring you provide accurate info and react immediately to customer requests, you can prevent unneeded problems and concentrate on what you do best.

And now, as promised, here’s your little bonus! As a thank you for taking the time to read this post, I’m using a totally free download of some adorable polar bear coloring pages and design templates. It’s a small method to add a little enjoyable to your day and supply a relaxing activity after navigating the sometimes-dry topic of taxes. You can find the download link [Place Download Link Here] I hope you enjoy them!

As always, if you have any concerns about the W-9 or any other tax-related matters, do not hesitate to leave a remark below. I’m constantly delighted to help. Up until next time, remain organized, stay informed, and happy freelancing!

W 9 Form Fill Out The IRS W 9 Form Online For 2023 Smallpdf

source : smallpdf.com

IRS W 9

source : www.useanvil.com

Free IRS Form W9 2024 PDF EForms

source : eforms.com

Free IRS Form W9 2024 PDF EForms

source : eforms.com