Hi everybody, and welcome back to the blog site! I’m always enjoyed connect with fellow freelancers and small business owners browsing the often-complex world of taxes. Today, we’re diving into an essential form that often causes confusion: the W-9. As someone who’s spent years advising on tax matters, I’ve seen firsthand how a little clarity on this form can save you a great deal of headaches down the line. So, let’s demystify the W-9, and as a special thank you for reading, I’m likewise offering a totally free download of some fun polar bear coloring pages and design templates– best for a relaxing break after taking on taxes!

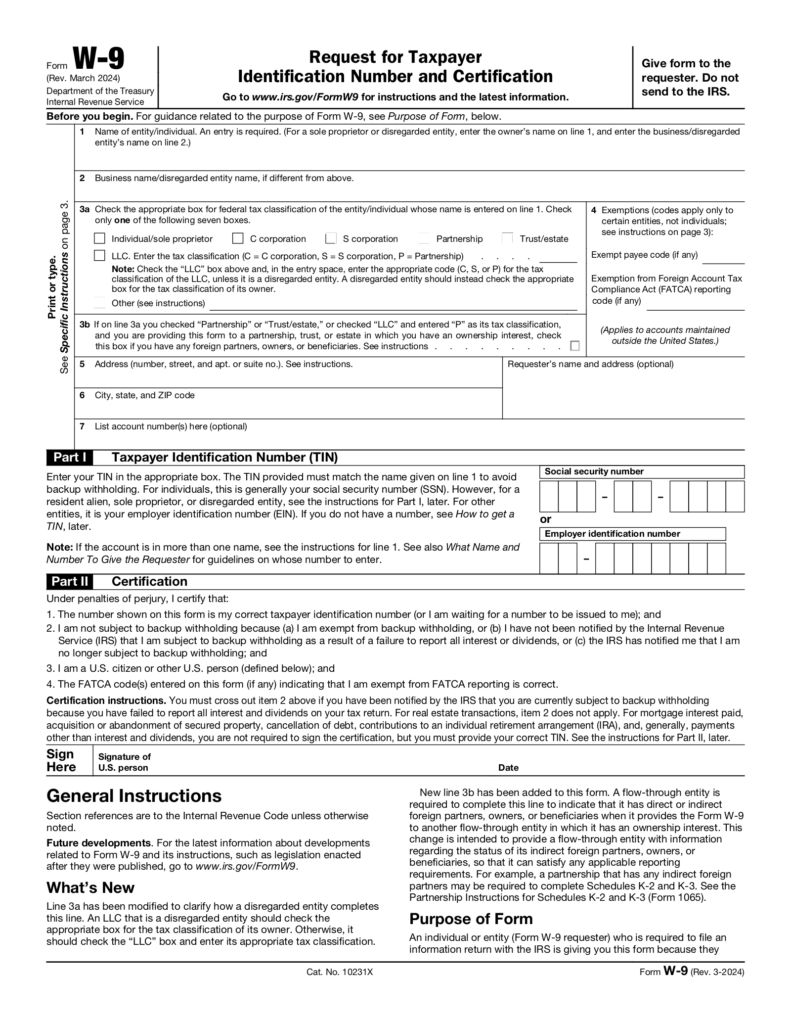

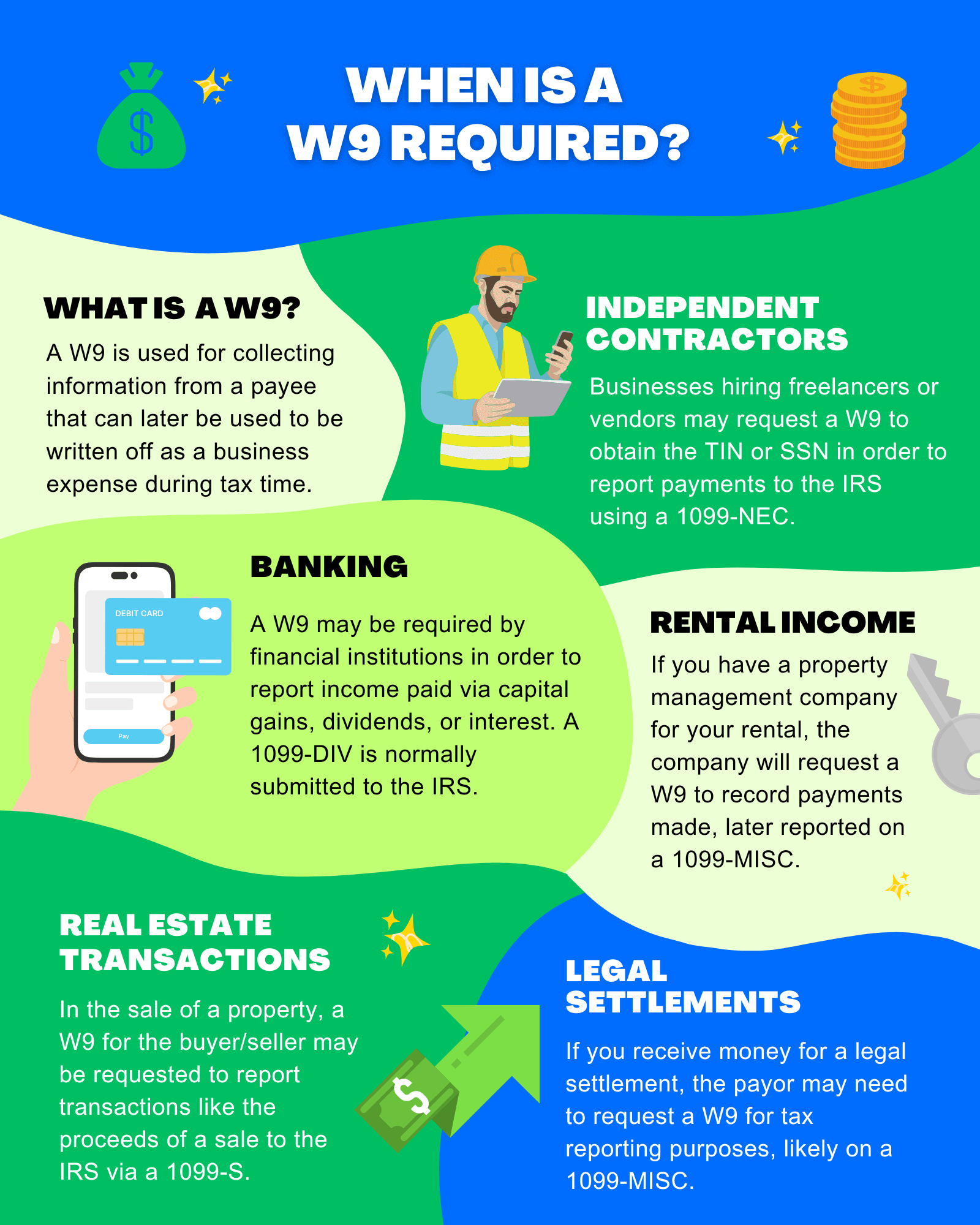

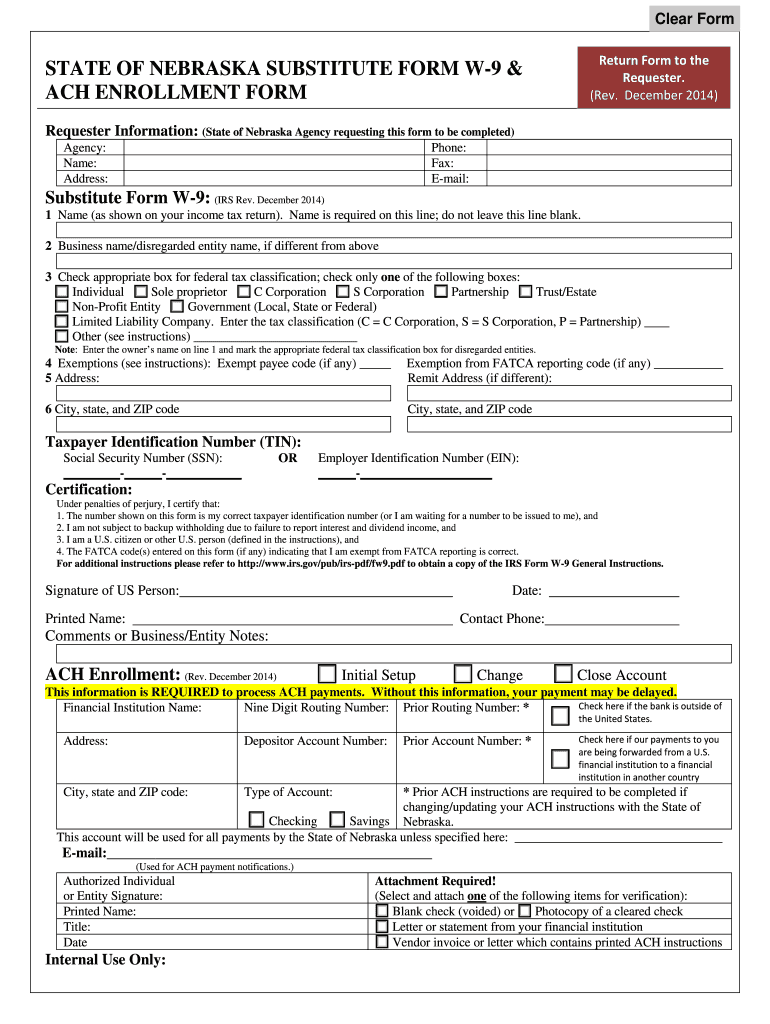

The W-9, formally entitled “Request for Taxpayer Identification Number (TIN) and Certification,” isn’t a kind you file with the IRS. Rather, it’s a kind you supply to your clients. Think of it as your service’s essential information sheet for tax purposes. When a customer pays you $600 or more in a fiscal year for services rendered, they are typically required to report those payments to the IRS using Form 1099-NEC (or 1099-MISC in specific scenarios). To properly complete this reporting, they need your appropriate taxpayer recognition details, which is exactly what the W-9 supplies.

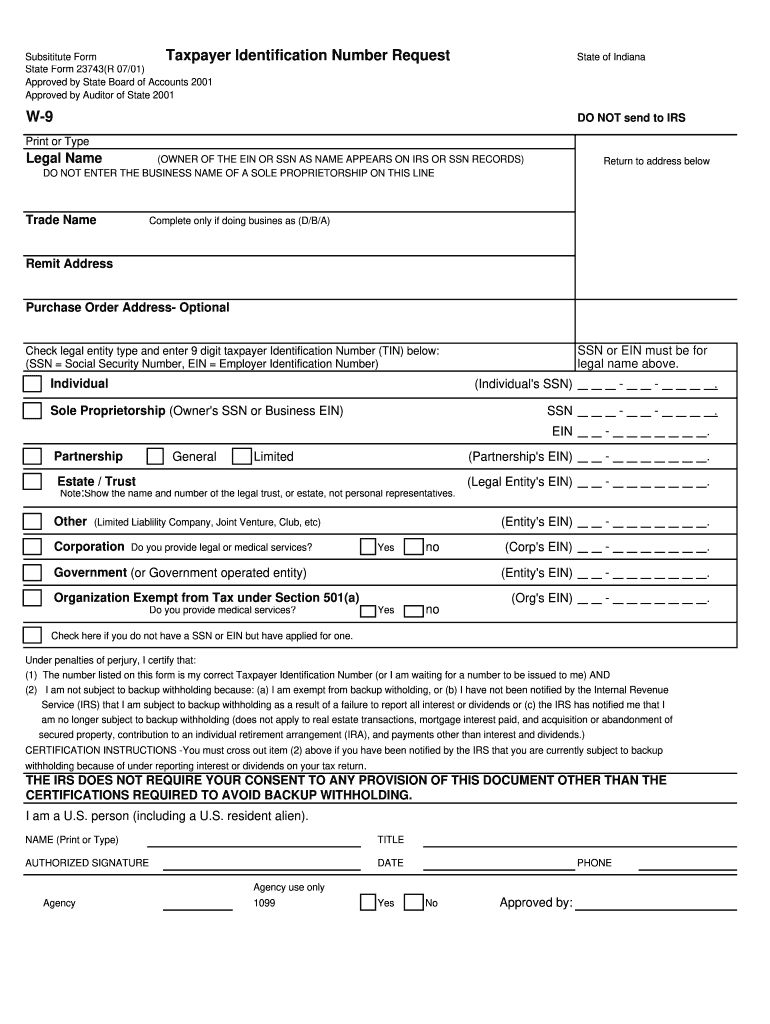

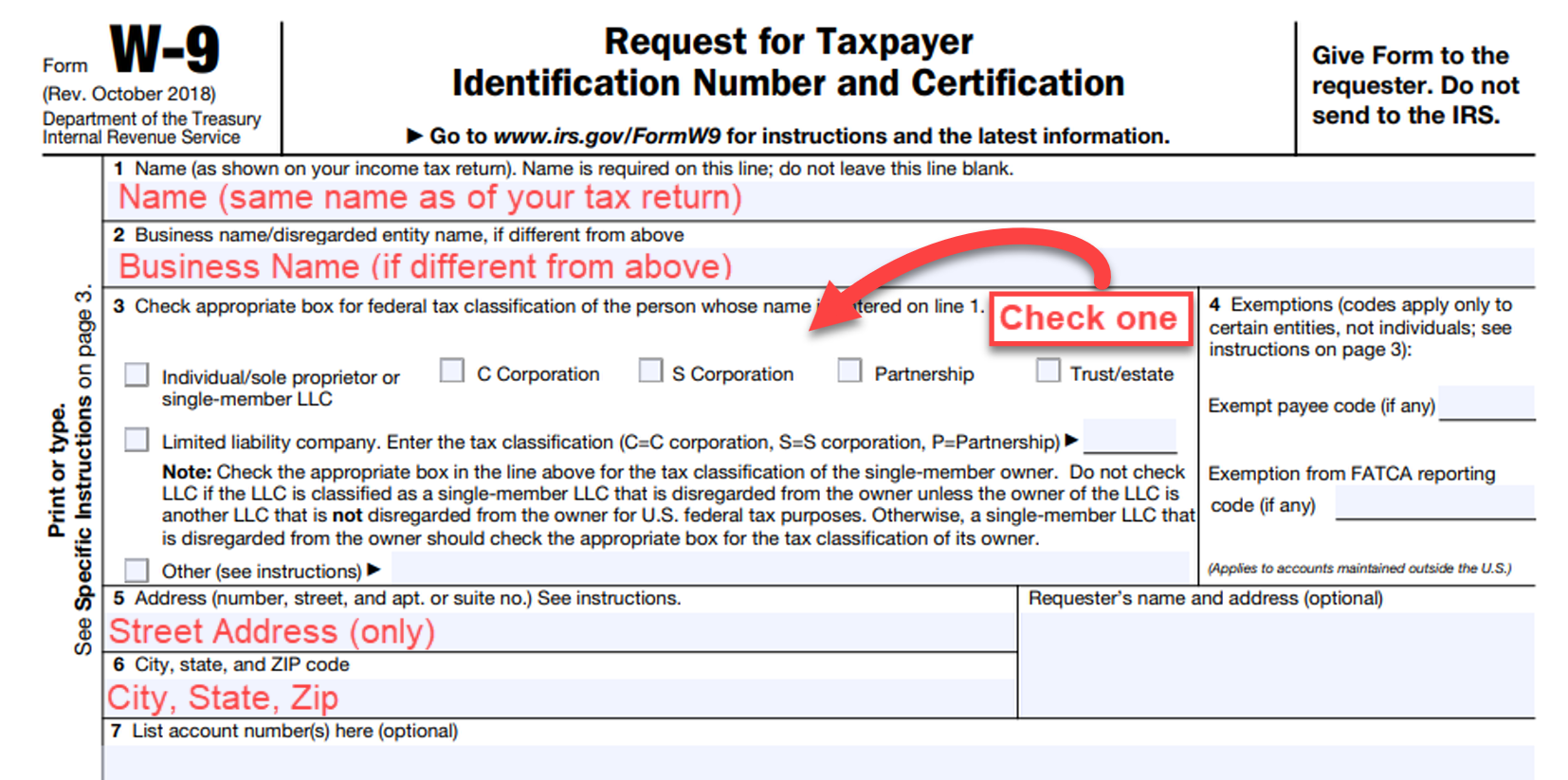

Printable W9 Form Indiana

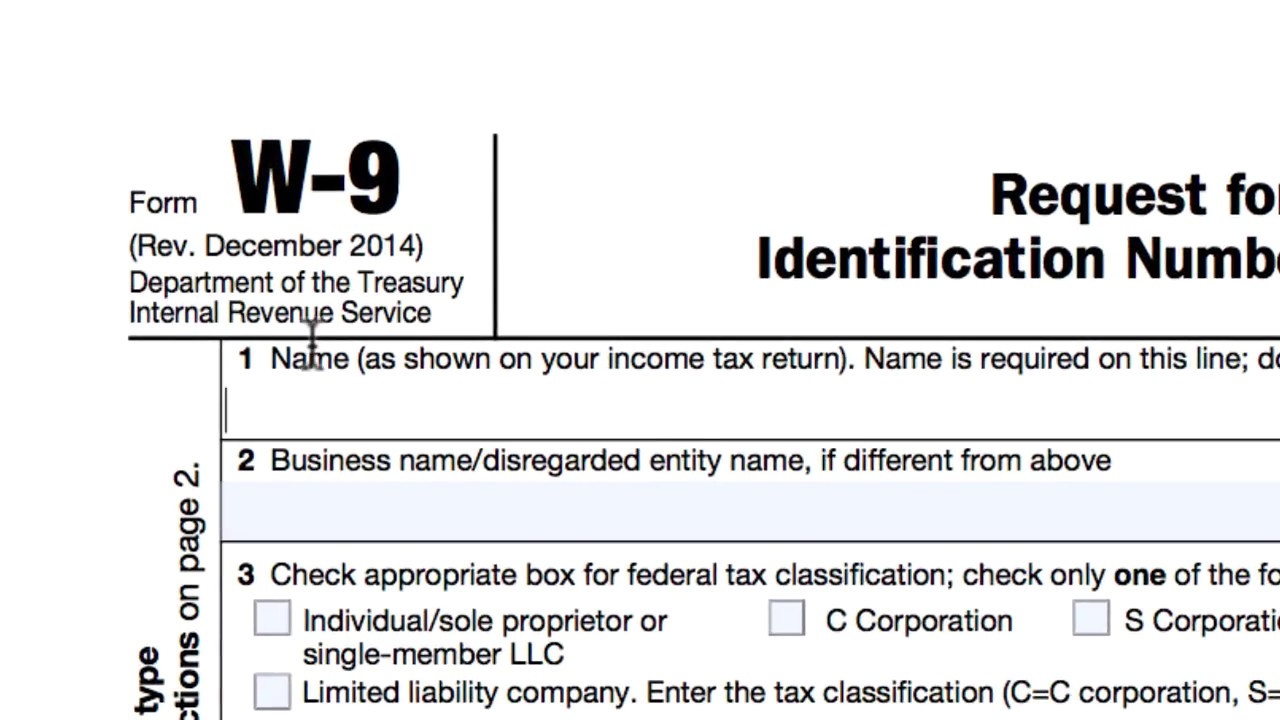

Free IRS Form W9 2024 PDF EForms

source : eforms.com

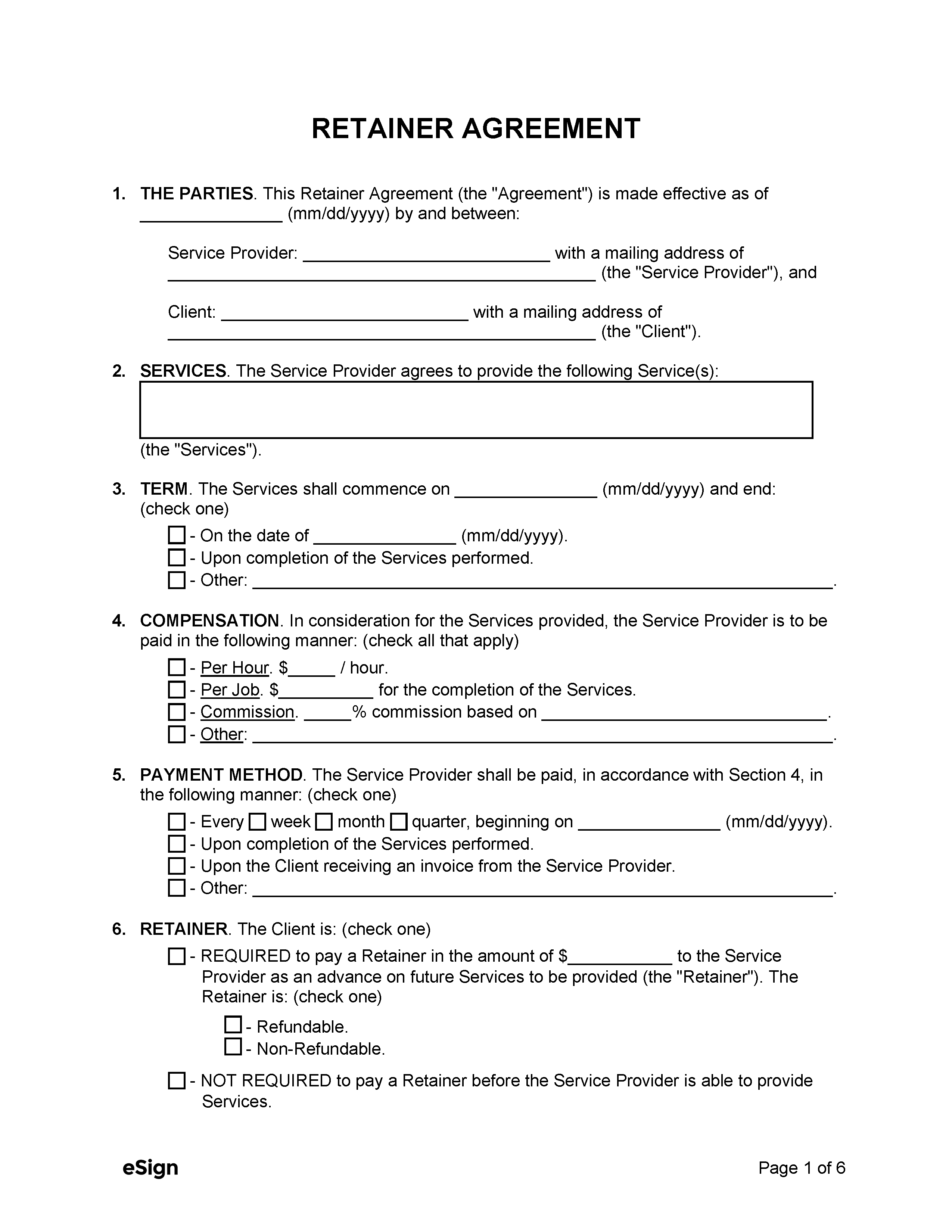

Free Independent Contractor Agreement Templates 8 PDF Word

source : esign.com

A typical question I receive is: “When should I fill out a W-9?” The answer is easy: whenever a client demands it. It’s a standard service practice, and immediately supplying a completed W-9 demonstrates your professionalism and helps keep a smooth customer relationship. Do not wait till completion of the year when your customer is rushing to issue 1099s.

Printable W9 Form Indiana – Another essential indicate keep in mind is that you should never ever send your W-9 to the IRS. You just supply it to the requesting payer. Keep a copy for your own records, however. This will help you reconcile any 1099s you receive at the end of the tax year.

Lastly, let’s address the “fillable ” element. While the IRS provides a PDF version of the W-9 that can be filled out electronically, it’s constantly great practice to keep a blank, copy on hand. This is particularly valuable if you’re satisfying a client face to face or if you prefer to have a physical copy for your records.

What Is A W9 Used For Fill Out Sign Online DocHub

source : www.dochub.com

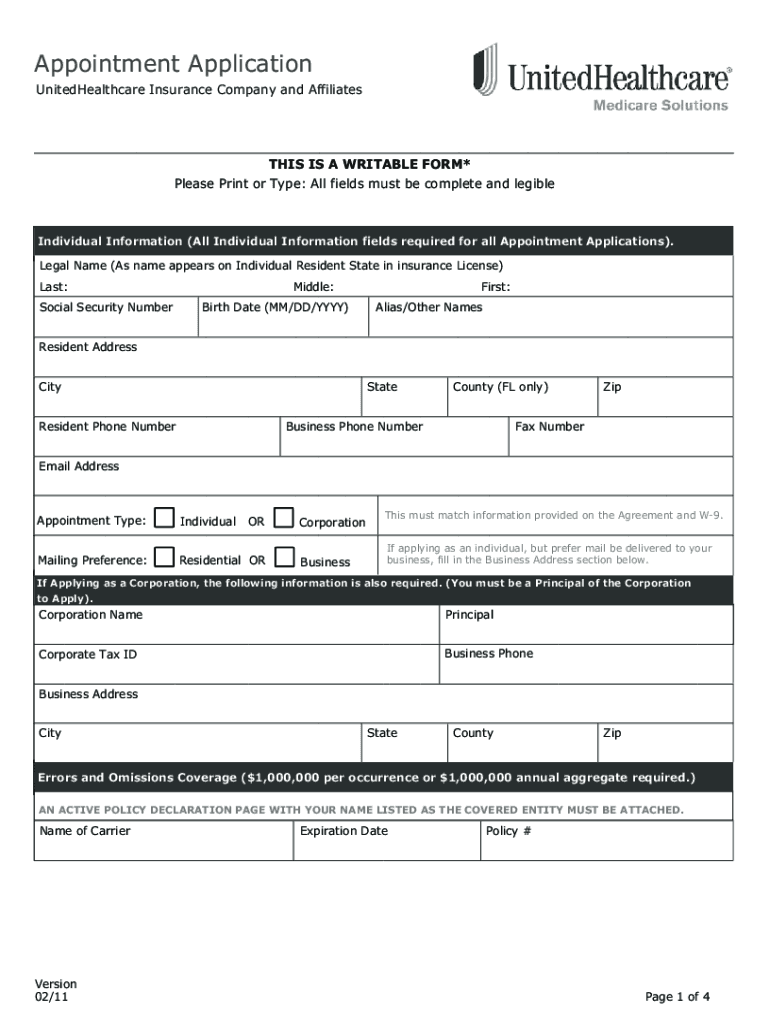

United Healthcare W9 Fill Out Sign Online DocHub

source : www.dochub.com

Fillable W 9 Fill Out Sign Online DocHub

source : www.dochub.com

How To Complete A W 9 Tax Form A Guide For Beginners

source : www.wikihow.com

Understanding the W-9 is a fundamental part of running an effective freelance service. By guaranteeing you supply accurate info and react promptly to client demands, you can avoid unneeded problems and concentrate on what you do best.

And now, as assured, here’s your little benefit! As a thank you for taking the time to read this post, I’m using a free download of some lovable polar bear coloring pages and templates. It’s a little way to add a little bit of enjoyable to your day and offer a relaxing activity after browsing the sometimes-dry topic of taxes. You can find the download link [Place Download Link Here] I hope you enjoy them!

As constantly, if you have any concerns about the W-9 or any other tax-related matters, feel free to leave a comment listed below. I’m constantly pleased to help. Up until next time, remain organized, stay informed, and happy freelancing!

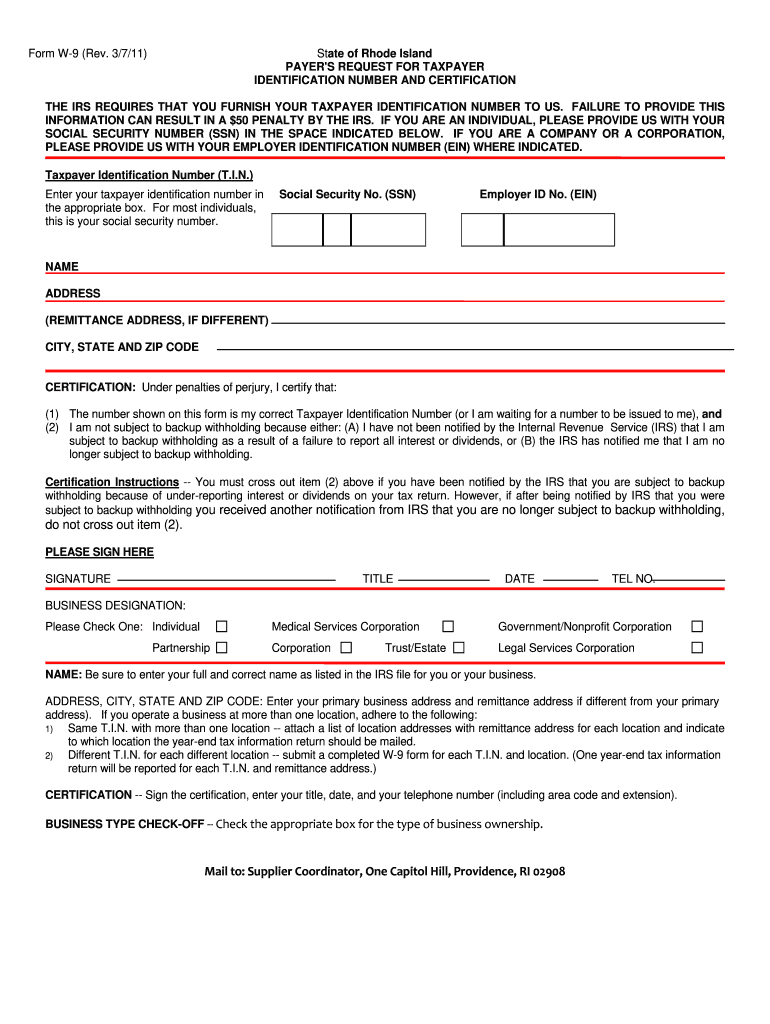

Taxpayer Identification Number Fill Online Printable Fillable Blank PdfFiller

source : taxpayer-identification-number.pdffiller.com

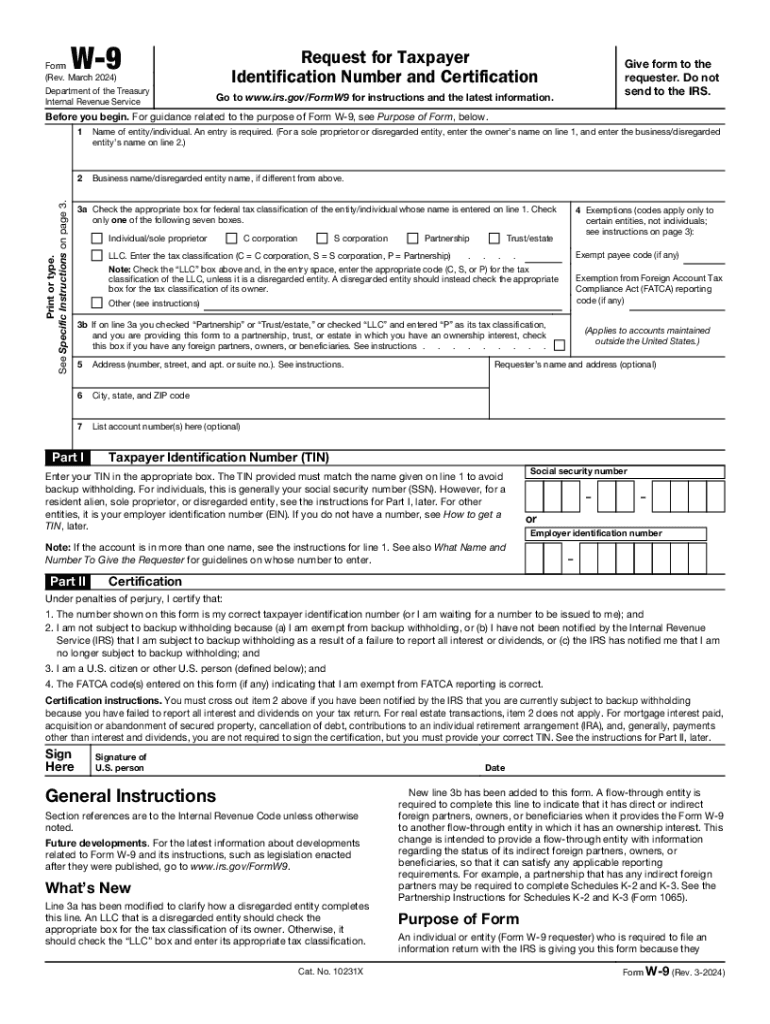

Free IRS Form W9 2024 PDF EForms

source : eforms.com

2024 Form IRS W 9 Fill Online Printable Fillable Blank PdfFiller

source : w9.pdffiller.com

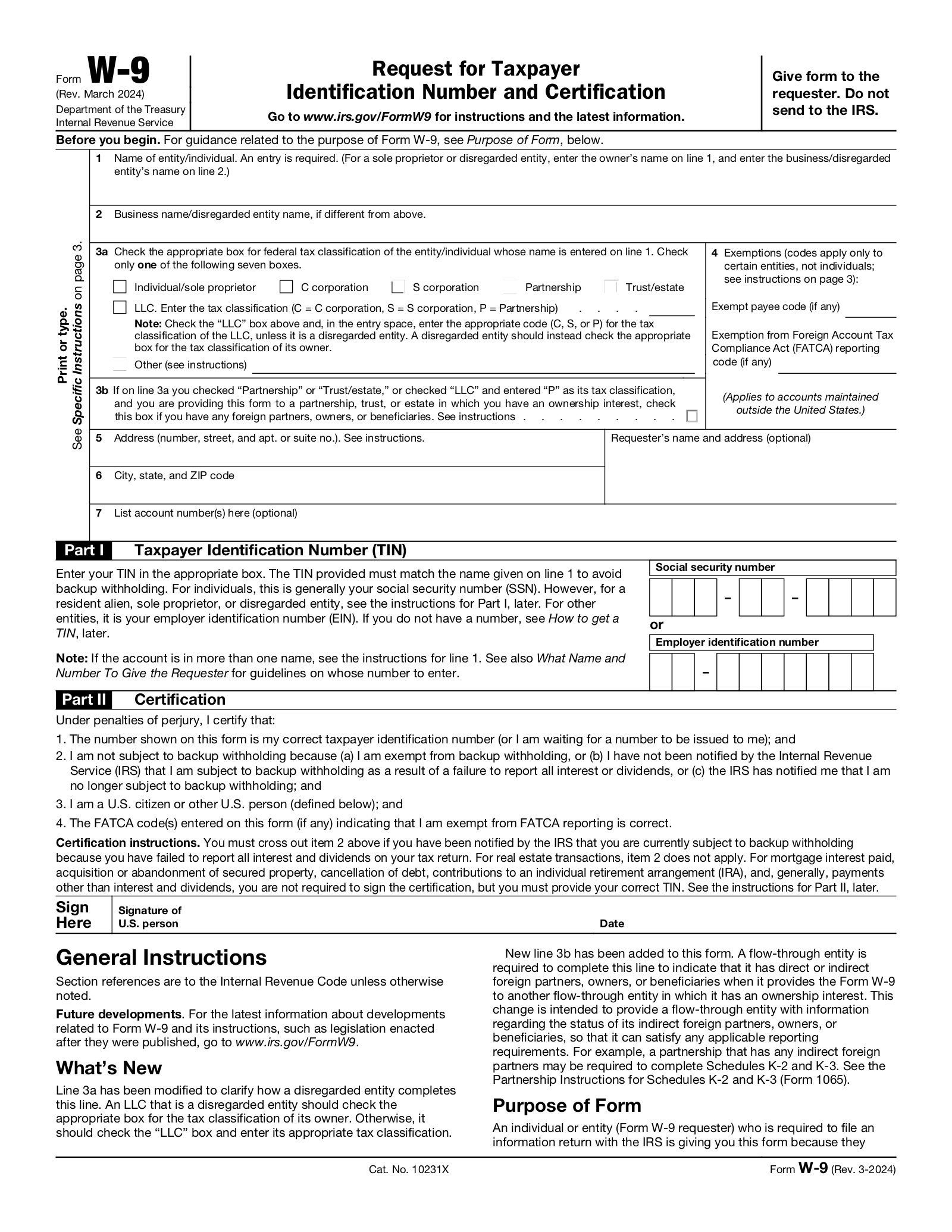

Free IRS Form W9 2024 PDF EForms

source : eforms.com